The price of platinum is in the midst of a rally that has led it to outperform assets considered safe havens such as gold and silver.

So far this year, as of 10 July (4 p.m. ET), the price of platinum had shot up 50.50%, while silver had advanced 28.33%, gold 26.63% and palladium 26.24%.

So far in July, platinum is among the best-performing metals in the main basket, up 0.41%, below silver’s 2.91% and palladium’s 4%.

Metals have performed exceptionally well so far this year due to a combination of factors ranging from increased demand as safe-haven assets, as in the case of gold, but also as strategic materials in industry.

Advance purchases made in response to fears generated by the trade war between the United States and China have also had a major impact.

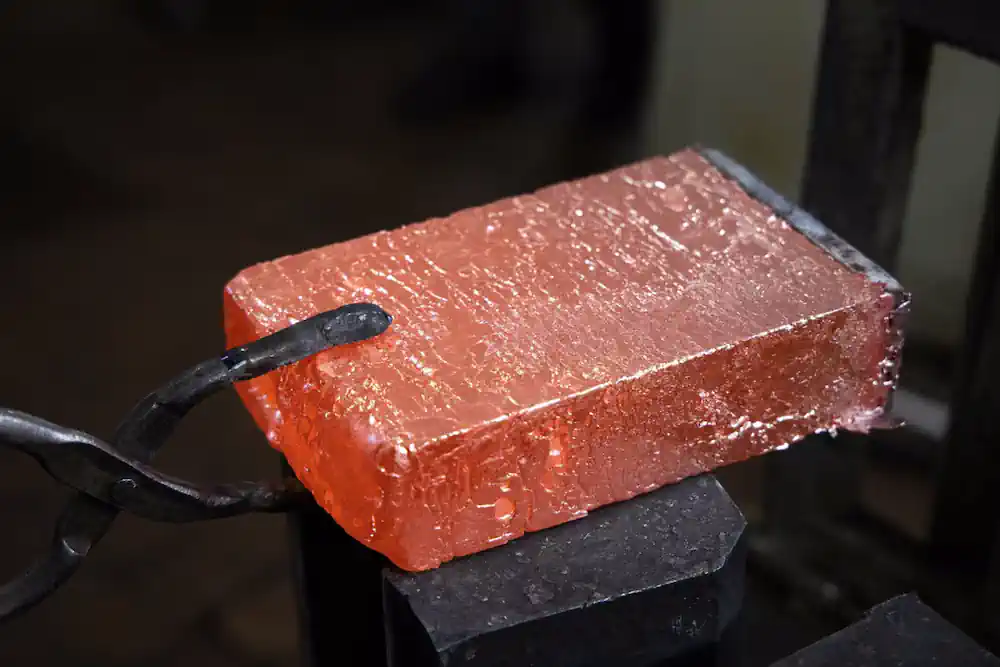

‘We are seeing a structural readjustment in the dynamics of this metal, driven by increasingly fragile supply and diversifying and strengthening demand,’ Paula Chaves, market analyst at HFM. ‘South Africa and Russia, the two main producers, face real obstacles that limit supply, from power outages and strikes to sanctions.’

According to Statista figures, South Africa produced approximately 120 metric tonnes of platinum last year.

It estimates that automotive applications accounted for more than 44% of global platinum demand in 2024.

According to Statista, ‘platinum is highly resistant to corrosion, among other desirable characteristics, making its value somewhat comparable to that of gold.’ For example, ‘the average price of platinum in May 2025 was US$971 per troy ounce, while the average price of gold in that month was US$3,280.51 per ounce.’

On Thursday, 10 July, the price of an ounce of gold stood at over US$3,324, while platinum climbed to US$1,364.

Financial analyst Gregorio Gandini points out that demand for platinum has increased in the automotive sector, especially for its use in catalytic converters, which help control vehicle emissions.

In addition, Gandini believes that given the high price of gold, many investors are turning to platinum and silver as safe-haven alternatives.

Analysts believe that platinum is regaining prominence in the automotive sector as a substitute for palladium, while at the same time consolidating its position as a key component in clean technologies, especially green hydrogen.

‘Added to this is a financial environment that favours metals: interest rates that could fall, a weak dollar and a growing search for safe havens by investors,’ said Paula Chaves, market analyst at HFM. ‘Everything points to platinum moving away from being a secondary player to positioning itself as one of the strategic metals of the new economic and energy cycle.’

According to a report by Michelle Leung, with contributions from several analysts, platinum producers have shown a stronger correlation between the price of the metal and their shares over the last six months.

Valterra Platinum — formerly Anglo American Platinum (the world’s largest producer) — maintains a relatively low correlation (0.48), compared to other companies that have seen increases to levels between 0.7 and 0.8, compared to 0.3 recorded in data from the last 10 years.

Even so, the upside potential remains: ‘The price of platinum could continue to appreciate’ given a deficit of 750,000 ounces forecast for 2025, according to the report.